In a new era of Internet banking and online e-commerce, the ever-increasing online criminals are constantly on the move to scam and cheat your important and private identity data such as credit card numbers, account details, user name and password credentials, and etc. I believe that some of you may have heard the story of or even known of somebody around you or your friends that has been felt into a phishing trap that caused a loss of money. One of the typical phishing methods is through phishing email and SMS message that are designed to direct victims to a fake look-alike website, and ask them to submit their sensitive information.

In order to protect yourself from this kind of phishing scam, so that you won’t be the next victim of online or mobile cheat victim, it’s important to maintain high alert when doing online transactions. It’s almost impossible to recover or claim back the lost money even if you report the criminal activity or case to the police or even Interpol. Thus, it’s strongly advisable to prevent yourself from fallen into phishing trap to prevent online scam from taking place.

Anyway, there is no 100% safe solution to protect your private and confidential data against Internet phishing, but you can exercise a few extra cautious steps for added prevention against phishing attacks.

Firstly, double confirm the URL address of visited website before submit your personal user name and password, no matter whether you’re browse it on a smartphone or a computer. You also can try to identify the site using search engines like Google and Bing. For example, you search the keyword (Citibank) and the official site of Citibank normally will be placed in a first ranking position among millions of results.

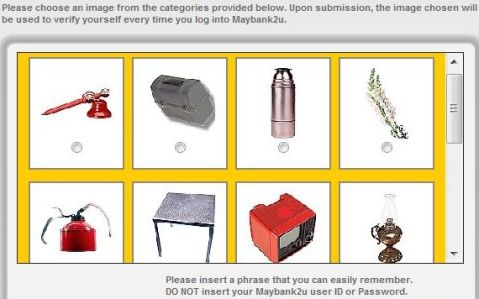

In addition, some banks has been trying to protect their customers form phishing issue by upgrading their web security systems to a next level with additional login requirement such as SMS verification, security tokens, or simple enhanced logging in verification to make sure you’re visiting the official log-in site by showing your registered image, phrase and so forth. Just make sure that you opt in to these additional security feature.

Thirdly, make sure you see https (Hypertext Transfer Protocol Secure) instead of http in the URL on the address bar while making payment or performing banking transactions.

Fourthly, it’s also possible to search for the URL of the web page that you visit on search engines such as Google or Bing to check if there is any other web surfers who complain about the website, or the website is indeed a malicious site with ill intent.

Fifthly, try to use just 1 credit card for all of your online transactions, it will help to minimize your loss by quick disabling the only credit card – if you be out of luck someday.

Sixthly is to know a simple fact. Most banks, corporations, online stores, or mobile carriers normally won’t ask their customers to confirm or verify their passwords and other details via SMS or email. If you receive this kind of message, be more alert.

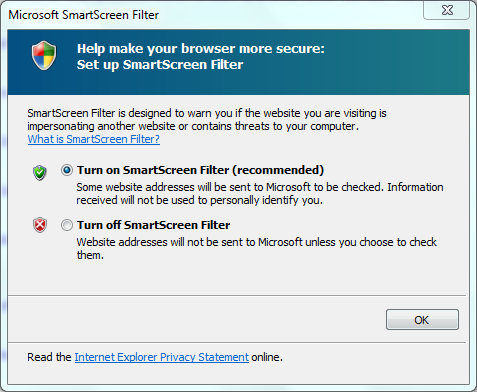

Last but not least, some web browsers and anti-virus or anti-malware have anti-phishing feature that able to check and verify each and every URI that you visit against database of known phishing sites or impersonation sites. For example, SmartScreen Filter in IE web browser. If you’re using such as browser or anti-virus and anti-spyware program, remember to turn on the anti-phishing functionality, and verify the site status before entering any important personal data or security credentials.

Hopefully several simple steps above will help you stay far away from phishing scams on both PC and mobile device.